Mandate:

The family-owned company KÖNIG + CO. is a globally renowned manufacturer of boiler tubes, cones, and special pressed parts with a history spanning almost 100 years.

HBH Holdings, Inc., based in Cincinnati, Ohio, USA, is a private investment and holding company specializing in manufacturing, maintenance, and construction services for the utility and industrial markets.

Zerbach & Company assisted the König family in successfully implementing the succession solution in this transatlantic transaction.

Type of Mandate: Sell side M&A Advisory

Clients: König family

Sector: Industrials

Buyer: HBH Holdings Inc., Cincinnati, USA

Website: www.koenig-co.de

Mandate:

Founded in 1908, THUN Automotive GmbH (“THUN”) employs around 400 people at its plants in Gevelsberg, Halver, Remscheid, and Vezprém, Hungary.

THUN is a manufacturer of metal components and assemblies produced by stamping, forming, turning, and a variety of joining technologies. The Company supplies automotive manufacturers with products for use in electrical/electronic applications, including electric drives, combustion engines, and non-drive applications such as chassis, interior fittings, and seats, as well as retaining and guide elements for doors and flaps.

Zerbach & Company advised THUN on the successful completion of the acquisiton by SteelCo GmbH, a portfolio company of RCP Group GmbH, Munich.

Type of Mandate: Sell side M&A Advisory

Clients: TA Holding GmbH

Sector: Automotive

Buyer: SteelCo GmbH

Website: www.thun-automotive.de

Mandate:

Innecken Group (“Innecken”) is a full-service provider in the field of electrical engineering for industrial and commercial customers and employs more than 200 people. Innecken is a supplier and service partner for power generation, conversion, and transmission of electrical energy, including power distribution, such as switchgear and transformers. Its core business areas are medium- and high-voltage systems, switch cabinet construction, and building automation.

GRÄPER Group operates at eight locations in Germany, the Netherlands, and Slovakia and develops product and service solutions in the fields of transformer stations and building materials.

Zerbach & Company supported Innecken in the successful implementation of the succession solution.

Type of Mandate: Sell side M&A Advisory

Clients: Shareholders of Innecken Group

Sector: Electrical engineering services

Buyer: GRÄPER Group, Ahlhorn, Germany

Website: www.innecken.de

Mandate:

VISCO Group, based in Jagstzell, Baden-Württemberg, Germany, is a provider in the field of passive telecommunications and energy infrastructure. As a general contractor, VISCO, with around 300 employees, offers its customers a full range of services from a single source and focuses on large-scale projects in the field of fibre-to-the-building (FTTB) and fibre-to-the-home (FTTH), as well as the laying of power lines.

Infra Group, headquartered in Temse, Belgium, is a leading provider of infrastructure services in Belgium, Germany, the Netherlands and France. It is owned by its management led by its founder Tom Vendelmans, and the private equity firms PAI Partners, ICG and Andera Partners.

Zerbach & Company advised the owner of VISCO Group on the successful execution of the sale of all shares to Infra Group.

Type of Mandate: Sell side M&A Advisory

Clients: Ralf Hammer (former owner VISCO Group)

Sector: Infrastructure

Buyer: Infra Group, Temse, Belgium

Website: www.visco.de

Mandate:

With a turnover of around 300 million Euros, NOBILIS GROUP is the leading, independent and owner-managed beauty distributor in the DACH region and has been operating successfully in the market for over 30 years.

With the inclusion of Gebr. Heinemann SE as a partner in the group of shareholders, the course has been set for sustainable and positive further development, which will secure the future of the company and the associated jobs in the long term.

Gebr. Heinemann is one of the world’s leading retailers and distributors in the international travel market, market leader in Europe and the only family-owned company among the global players in travel retail. Since its foundation in 1879, the family business has been based in Hamburg’s HafenCity and has been managed by members of the Heinemann family ever since.

Zerbach & Company advised the shareholders of NOBILIS Group in the successful implementation of the share sale.

Type of Mandate: Sell side M&A Advisory

Clients: Udo Heuser and Dr. Joachim Henseler

Sector: Beauty

Buyer: Gebr. Heinemann SE & Co. KG

Website: www.nobilis-group.com

Mandate:

BID Group was founded in 1985 as a debt collection agency and credit agency and is today one of the two largest, group-independent debt collection companies in Germany.

Z&C was exclusively mandated to advise on the sale of the entire group of companies to an investor with a long-term investment horizon as part of the succession plan.

With the Obermark Group, the former owner selected a partner who will further promote and secure the successful development of BID Group in the long-run.

“Zerbach & Company is one of the few corporate finance firms that considers the interests of all parties in their mandates. They work creatively to find solutions on how to increase the value of a transaction for all parties involved and then to share this value fairly between their clients and the negotiating parties. That’s how you succeed in deals that all parties are satisfied with, even in the long run.“

Dr. Peter Sewing

Founder and Managing Director Obermark Group

Type of Mandate: Sell-side M&A advisory

Client: BID Group

Sector: Financial Services (debt collection)

Buyer: Obermark Value S.a.r.l.

Website: www.bid-coburg.de

Mandate:

The Expanded Metal Company (“EMCO”) is a specialist in expanded metal mesh and was formerly part of the Expamet group of companies.

Based in Hartlepool, North-East England, the company is a leader and innovator in the design and manufacture of expanded metal mesh, from building materials to filters, grilles, walkways and visually striking architectural matting.

EMCO serves a variety of industries including construction, filtration, automotive, aerospace, architectural, agricultural, acoustical, and security. The company was founded by John French Golding, the inventor of expanded metal. His first British patent was granted in 1884.

Zerbach & Company advised the US-based Private Equity fund EIH Capital Partners in the successful implementation of the portfolio sale.

Type of Mandate: Sell side M&A Advisory

Client: EIH Capital Partners LLP, USA

Sector: Metal processing

Buyer: MEISER Group, Schmelz-Limbach

Website: www.expandedmetalcompany.com

Mandate:

Founded in 1950, BAHAMA is today a leading manufacturer of high-quality sunshades for the catering and hotel industry and private customers from all over the world. The company is the technology and quality leader for large professional parasols. The outstanding feature is the wind stability up to 130 km/h. The BAHAMA large umbrellas are manufactured in Germany with an in-house production quota of almost 100% and are sold in over 50 countries. Among the customers are numerous national and international top hotels and restaurants. One of the most prestigious projects was the exclusive delivery of sunshades for the landmark of Dubai, the luxury hotel Burj Al Arab.

BPE is a specialist in management buy-ins (MBI) and management buy-outs (MBO) for succession arrangements and corporate spin-offs in medium-sized companies. BPE invests in high-growth companies in German-speaking countries with sales of up to € 100 million with the aim of preserving the independence and the medium-sized character of the respective company and at the same time increasing the company’s value.

Zerbach & Company advised the shareholders of Bahama GmbH in the successful implementation of the company succession.

Type of Mandate: Sell side M&A Advisory

Client: Owner families Schroeder and Lessmann

Sector: Outdoor equipment

Buyer: BPE Private Equity, Hamburg

Website: www.bahama.de

Mandate:

In 1867, SORST was founded by Wilhelm Sorst in Hanover as a locksmith’s shop. In 1901, the industrial production of perforated sheeting began, followed by the manufacture of steel cabinets made of expanded metal in 1919. As early as 1921, SORST became the leading manufacturer of expanded metal and perforated sheeting in Germany. After the company was split into two divisions in 1998, today’s SORST Streckmetall GmbH was formed.

Since 2016, SORST has been the German market leader for expanded metal and one of the leading brands in Europe. In the same year, the US private equity fund EIH Capital Partners had acquired the company from Gibraltar Industries and had now reached the end of its investment period.

Zerbach & Company advised the US-based Private Equity fund EIH Capital Partners in the successful execution of the portfolio sale.

Type of Mandate: Sell side M&A Advisory

Client: EIH Capital Partners LLP, USA

Sector: Metal processing

Buyer: MEISER Group, Schmelz-Limbach

Website: www.sorst.de

„We got to know the Zerbach & Company team at the beginning of 2015. Through the mix of professional work, always open communication in combination with a very pleasant collaboration on a personal level, Zerbach & Company has subsequently been able to contribute important pieces of the puzzle to make the extremely rapid growth of our tonies® audio figures conquerable.“

Patric Faßbender & Marcus Stahl

Founders and former CEOs of Tonies SE

Mandat:

Boxine GmbH (now Tonies SE), founded in 2014, produces the Toniebox, an audio system for children. The Toniebox is a fabric-wrapped cube with an integrated speaker for young children to play audio books and music, which has become a very big success in Germany. The box works by means of a figure that has to be placed on the box in order for the corresponding audio play to be played.

In 2015, Z&C advised the Kraut family office in acquiring a 25+% stake in Boxine GmbH. Until the market launch of the Tonies and in the following years 2016-2018, Z&C provided various corporate finance services and supported the development of the internal organizational structures of the rapidly growing startup. In 2019, Z&C then advised the family office of the Kraut family as a minority shareholder in the sale process to an investor consortium consisting of Armira (lead investor), as well as the family offices of the founders of Hexal and Zalando, among others.

Type of Mandate: Buy-side M&A Advisory (minority) | Corporate Finance | Sell-side M&A Advisory (minority)

Clients: Kraut Family Office | Boxine GmbH | Kraut Family Office

Sector: Consumer goods (toys)

Buyer: Kraut Family Office | Armira

Website: www.tonies.com

Mandate:

MBE, founded in 1979, is a leading supplier of painted fasteners for high-quality building facades and primarily supplies the German specialized trade with painted fasteners for curtain-type, rear-ventilated facades.

Z&C’s assignment was the sale of 100% of the shares to a long-term oriented buyer in order to regulate the succession of the company and to secure the jobs at the Menden location.

Due to the high speed of the process and the structured, competitive bidding process, the transaction including preparation phase was completed by Z&C in less than 5 months.

„After we had decided to sell our life’s work in mid-2019 after many detailed discussions, we started looking for a suitable M&A advisor for the purpose of implementing our plan. Zerbach & Company prevailed over two other advisory firms that came into question and we have not regretted the decision in any way. Decisive for our choice were not only the personal chemistry but also the references and the experience of the team in the field of construction elements as well as the professional and at the same time unpretentious appearance of the employees. In only 5 months including the preparation phase – which we would not have thought possible at the beginning – we were able to complete the competitive process with the successful sale to the listed, Swiss SFS Group. During this intensive, highly emotional phase, we felt that Zerbach & Company was committed and trustworthy at all times.“

Peter Gülde

Former Managing Director and shareholder of MBE

Type of Mandate: Sell-side M&A advisory

Client: MBE Moderne Befestigungselemente GmbH

Sector: Construction

Buyer: SFS Group AG

Website: www.mbe-gmbh.de

„I really liked the modular approach of Zerbach & Company. In the first step, I was able to approach the topic of succession or company development via a company valuation and thus also get to know the high-quality advisory of Zerbach & Company. And after I had made a decision in the second step to reorganize the shareholder structure of my company, Zerbach & Company was a professional advisor and companion for me in an environment that had been completely foreign to me until then, and all of this on an extremely pleasant human basis at the same time.”

André Barth

Former Managing Director and shareholder of DuoTherm

Mandat:

DuoTherm is a leading manufacturer and distributor of roller shutter, venetian blind and external venetian blind systems as well as fabric shading systems.

Z&C’s assignment was the sale of up to 100% of the shares to a long-term oriented private equity sponsor or a family office for the early regulation of the succession with simultaneous re-investment of the managing partner, who will continue to accompany and shape the growth of the company.

Due to the high speed of the process and the effective project management, the transaction including the preparation phase was completed in less than 5 months.

Type of Mandate: Sell-side M&A advisory

Client: DuoTherm Rolladen GmbH

Sector: Construction

Buyer: BPE Unternehmensbeteiligungen GmbH

Website: www.duotherm-rolladen.de

Mandate:

Schmetz Group is a traditional company that has been in existence since 1851 and is one of three leading manufacturers of industrial sewing needles worldwide. The company employs around 700 people at production sites in Germany, Switzerland and India as well as worldwide sales offices.

Z&C’s mandate was to sell a majority shareholding to a long-term investor in order to regulate the succession and at the same time secure the long-term existence of the company.

In the end, the shareholders decided to sell the company to the competitor Groz-Beckert, the global market leader in the field of industrial machine needles, precision parts and fine tools for the production and joining of textile surfaces with more than 7,800 employees.

Type of Mandate: Sell-side M&A advisory

Client: Schmetz Capital Management GmbH

Sector: Textiles

Buyer: Groz-Beckert KG

Website: www.schmetz.com

Mandate:

Cofresco, a subsidiary of Melitta Group, is Europe’s leading manufacturer of branded products for household foils and papers. As part of its “Melitta 2020” strategy program, the Melitta Group intended to selectively strengthen its existing business areas through targeted acquisitions.

Z&C’s mandate was to develop an acquisition strategy and to identify potential target companies across Europe for Cofresco to strengthen the Foodservice division, which meet the jointly defined acquisition criteria and thus meaningfully complement Cofresco’s existing business in this area.

Type of Mandate: Target Search

Client: Melitta Zentralgesellschaft mbH & Co. KG

Sector: Packaging / Foodservice

Website: www.cofresco.de

Mandate:

Buurtzorg is a revolutionary care model from the Netherlands with which the parent company has revolutionized the care market there since 2006. In just 10 years, Buurtzorg has become the largest outpatient care provider with over 14,000 employees. What is special is that these 14,000 people all work in small, independent care teams with a maximum of 12 colleagues: no care management, no hierarchies, no boss.

To accelerate the expansion of its market position in Germany, Buurtzorg Germany intends to accelerate its organic and inorganic growth in the coming years in order to become the leading outpatient care service in Germany as well, following the Dutch example.

In this context, Zerbach & Company has raised growth capital from a family office, which is committed to the future of Buurtzorg Deutschland as a long-term shareholder.

Type of Mandate: Growth Financing

Client: Buurtzorg Deutschland Nachbarschaftspflege gGmbH

Sector: Healthcare

Buyer: German single family office (confidential)

Website: www.buurtzorg-deutschland.de

Mandate:

Founded in 1935 by Friedrich Schleich in Schwäbisch Gmünd, Schleich is now one of Germany’s largest toy manufacturers and a leading international supplier of realistic animal figures.

The company now offers six different theme worlds with more than 600 designed and high-quality individual figures. Production takes place both at the company’s headquarters in Schwäbisch Gmünd and at other production facilities abroad.

After Leander Zerbach had already advised on behalf of the owner family on the sale of Schleich to HgCapital in 2006, Z&C was mandated to advise the former Schleich CEO and minority shareholder on the secondary buy-out by Ardian.

„My relationship with the partners of Zerbach & Company goes back as far as 2004, when Leander Zerbach subsequently succeeded in bringing together four shareholders with very different interests and very successfully sold their stake in the world’s leading toy figure manufacturer Schleich to HgCapital in a competitive auction process. Since that time, I have worked very closely and trustfully with Leander Zerbach, Dr. Lars Junc and Marc Bollinger. They advise me on my various activities with own production sites in North Africa and China, as well as startups such as Boxine (Tonies®), Fazua, Demecan, SpyraOne and Tigerbox.”

Paul Kraut

Angel Investor, former CEO and shareholder Schleich GmbH

Type of Mandate: Sell-side M&A advisory

Client: Paul Kraut

Sector: Consumer goods (toys)

Buyer: Hg Capital (2006) / Ardian (minority, 2014)

Website: www.schleich-s.com

„I have been working with Mr. Zerbach in the field of Mergers & Acquisitions for 17 years and with the team of Zerbach & Company since its foundation in 2014. The team does not act as a “company broker” but is very well prepared to first carefully record the situation of the company and that of its shareholders and, on this basis, develop a professional concept for the further course of action, always exclusively in the interest of the respective client, either on the buyer’s side or on the seller’s side. In particular, the team has special expertise in dealing with complex shareholder structures and demanding entrepreneurial personalities. With great prudence, perseverance and a sense of proportion, Zerbach & Company has thus already succeeded in leading numerous corporate transactions to the desired success in a targeted manner.”

Dr. Martin Hüttermann

Breidenbach & Partner

Mandate:

Nickut Catering, founded in 1995, is a catering service provider with strong regional roots and a wide range of services. As a caterer, Nickut Catering offers its customers the choice between direct hot catering or the flexible regeneration process “Cook & Chill”. Nickut’s delivery area is currently focused on the North-Rhine Westphalia region. This allows for a quick response time without compromising on quality.

The owner of Nickut Catering engaged Zerbach & Company as exclusive corporate finance advisor with the search for suitable partners to secure the sustainable development of the company as well as the jobs at the location.

Type of Mandate: Sell-side M&A advisory

Client: Nickut Catering GmbH

Sector: Catering

Buyer: Single family office (confidential)

Website: www.nickut-catering.de

Mandate:

The Germania Group, consisting of Germania Inkasso Dienst GmbH & Co. KG and Eurania AG, was founded in 1985 as a debt collection agency by Herrmann Lehner in Deggendorf, Bavaria, and is today a leading service provider in the field of debt collection and receivables management for B2B customers in Germany.

Z&C was exclusively mandated to advise on the overall sale of the group of companies as part of the succession plan.

With AEM Unternehmerkapital GmbH, the former owner selected a partner who will continue to secure and operationally manage the successful development of the company in the future.

Type of Mandate: Sell-side M&A advisory

Client: Germania Inkasso-Dienst GmbH & Co. KG / Eurania AG

Sector: Financial Services (debt collection)

Buyer: AEM Unternehmerkapital GmbH

Website: www.germania-inkasso.de

Mandate:

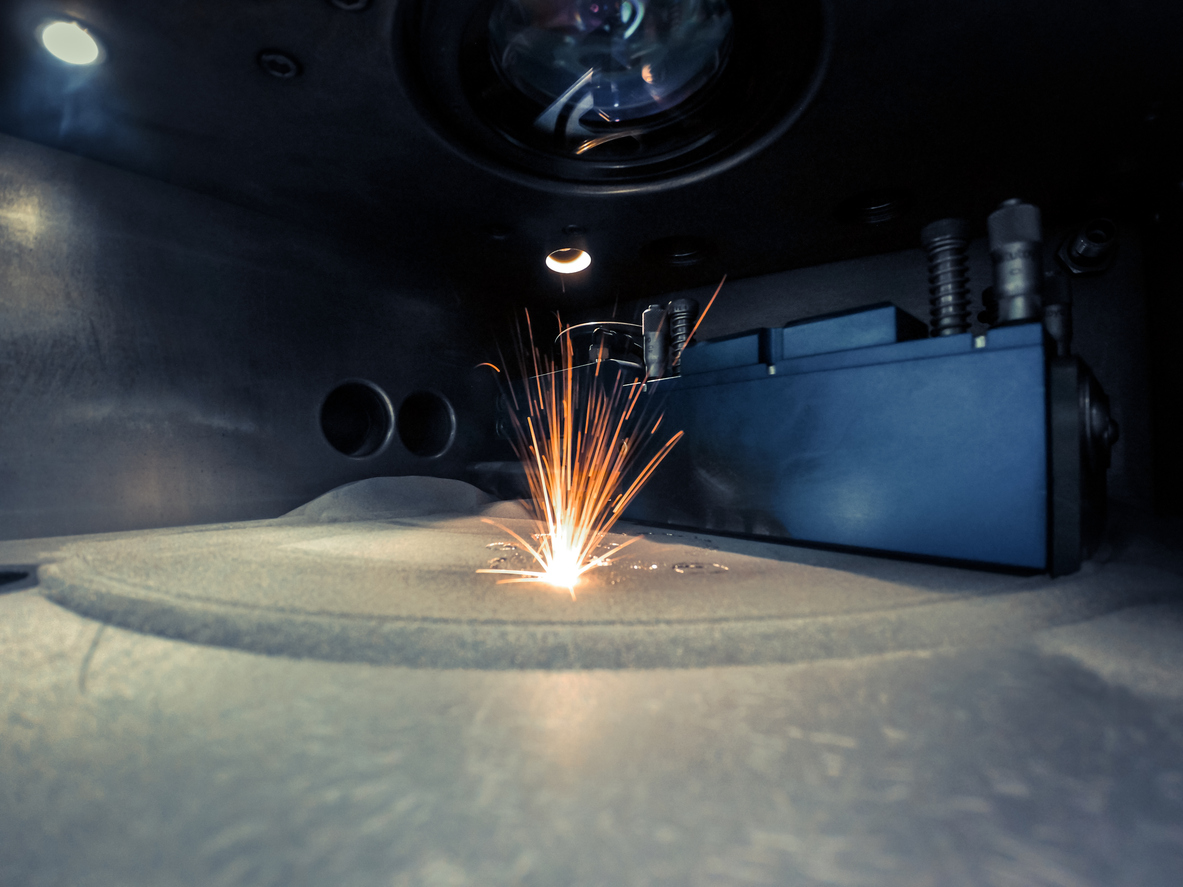

LUNOVU develops, builds and sells complex laser systems and offers its customers integrated solutions for the respective production or development tasks, e.g. in additive manufacturing, laser cladding or micromachining. The unique products consist of high-performance hardware, in-house developed control software and application-specific laser process knowledge.

Zerbach & Company assisted LUNOVU in raising growth capital by adding S-UBG as a new minority shareholder.

Type of Mandate: Sell-side M&A advisory

Client: LUNOVU GmbH

Sector: Additive Manufacturing

Buyer: S-UBG AG

Website: www.lunovu.com

Mandate:

DEMECAN, founded in 2017 by Dr. Adrian Fischer, Dr. Cornelius Maurer and Dr. Constantin von der Groeben, is the only German company that covers all manufacturing steps for medical cannabis from a single source – from cultivation to further processing and storage to nationwide delivery to pharmacies.

Accompanied by Zerbach & Company, the family office PHK Enterprise acquired a minority stake in DEMECAN and supported the company with seven-digit growth capital. PHK Enterprise became part of the existing investor group, which includes DEMECAN’s founders, the investor network Btov Partners and the family office of Bernhard Schadeberg, owner of the Krombacher brewery.

Type of Mandate: Buy-side M&A advisory (minority)

Client: Paul Kraut

Sector: Healthcare

Target: DEMECAN Holding GmbH

Website: www.demecan.de

Mandate:

Leipold + Döhle GmbH is an importer and wholesaler of occupational safety products based in Eschwege. The company sells its products mainly to DIY stores and the technical trade.

Z&C’s mandate was the sale of up to 100% of the shares in order to regulate the succession of the company and at the same time to secure the long-term existence of the company.

Type of Mandate: Sell-side M&A advisory

Client: Leipold + Döhle GmbH

Sector: Wholesale

Buyer: ASUP GmbH (portfolio company of Maxburg Capital Partners)

Website: www.leipold-doehle.com

Mandate:

Cologne-based insurance broker Frischleder is a leading specialist in brokering insurance solutions for the real estate industry. In this context, the company designs the optimal insurance coverage for investors from the purchase of the land, to the project development, to the coverage of the completed property.

In the context of the regulation of the company succession, the shareholders of Frischleder commissioned Z&C as exclusive corporate finance advisor with the search for suitable partners for the takeover of the business shares in order to secure the jobs at the Cologne location in the long term.

In the course of a competitive transaction process, MRH Trowe, an internationally positioned insurance company, was selected by the shareholders.

Type of Mandate: Sell-side M&A advisory

Client: Frischleder Versicherungsmakler GmbH

Sector: Insurance

Buyer: MRH Trowe Group (portfolio company of Anacap)

Website: www.mrh-trowe.com

Mandate:

Since 1950, the company has been engaged in the manufacture of architecturally sophisticated all-weather large umbrellas for commercial use in the hotel industry, gastronomy, municipal gardening and landscaping and on cruise ships and ocean-going yachts.

The assignment was the sale of 100% of the shares to regulate the age succession and at the same time to secure the long-term and sustainable perspective of the company and the 100 jobs.

At the same time, the current shareholder structure, consisting of several family trunks, was to be adjusted in order to resolve the existing conflicts. With Volker Schröder, formerly CFO of the Kienbaum Group, Z&C found an internationally experienced MBI candidate who will continue to expand the company in the long term as managing partner.

Type of Mandate: Sell-side M&A advisory / MBI

Client: Bahama GmbH

Sector: Textile constructions

Buyer: Private Investor

Website: www.bahama.de

Mandate:

W.u.H. Fernholz GmbH & Co. KG has been producing plastic packaging and films for the dairy and food industry since 1963. In addition to the main plant in Meinerzhagen, there has been a second plant in Schkopau near Halle an der Saale since 2009. In Meinerzhagen, packaging is produced using thermoforming and injection molding processes, as well as films made of PS (polystyrene), PP (polypropylene) and PET (polyethylene terephthalate). The Schkopau plant specializes in the production of film, especially for the dairy industry, from PP and PS. With around 220 employees, Fernholz processes 2,000 tons of plastic granulate every month, which corresponds to approximately 2.5 billion packages per year.

Z&C’s assignment was the support and implementation of a family-internal shareholder restructuring within the scope of an owner buy-out.

Type of Mandate: Owners Buy-out

Client: W. u. H. Fernholz GmbH & Co. KG

Sector: Plastic packaging

Buyer: Uwe Fernholz

Website: www.fernholz-verpackungen.de

Mandate:

Thiendorfer Fräsdienst GmbH & Co. KG is a specialized, Germany-wide provider of milling services for all traffic areas in the road network and for large operational areas.

The assignment was the sale of 100% of the shares to regulate the succession and at the same time to secure the long-term and sustainable perspective of Thiendorfer Fräsdienst GmbH & Co. KG and to secure the approximately 100 jobs.

The buyer is a subsidiary of L. Possehl & Co. mbH, the management holding company of the non-profit Possehl Foundation. This corporate structure enables the Possehl Group to remain independent and forms the foundation for long-term perspectives of the acquired companies.

Type of Mandate: Sell-side M&A advisory

Client: Thiendorfer Fräsdienst GmbH & Co. KG

Sector: Road construction

Buyer: Possehl Spezialbau GmbH

Website: www.thiendorfer.de